by Fresh Start Tax | Apr 24, 2013 | Tax Help

Wage Garnishment – IRS Tax Attorneys, Lawyers – Experts in Wage Garnishments Removal, Settlements 1-866-700-1040

If you need immediate removal of an IRS wage garnishment contact us today for immediate tax relief and get your case settled.

We are comprised of IRS tax attorneys, tax lawyers, certified public accountants, enrolled agents, and former IRS agents managers and tax instructors.

We have over 206 years professional tax experience and over 60 years of working directly for the Internal Revenue Service has agents and managers. While at the Internal Revenue Service we also taught collection tax law.

Because of our term of service at the Internal Revenue Service we are tax experts in the removal of wage garnishments and tax settlements. As a result of our 60 years at IRS, we know the exact systems, the exact protocols, and the exact methods in which IRS releases wage garnishment levies and how they settle their cases.

Why did IRS send out a Wage Garnishment

IRS sends out a series of three or four billing notices to the last known address of the taxpayer which address shows up as a result of the filing of their last filed income tax return.

IRS is allowed by law only to send that last billing notice to the last address shown on their tax return. No other requirement needs to be met. IRS makes no other attempt to contact the taxpayer.

If the taxpayer does not comply to IRS request to contact the one 800 number shown on the final notice of their bill, the IRS systemically sends out a wage garnishment levy to the taxpayers employer.

The employer is usually found on a W-2 or other income indicators that the Internal Revenue Service has on their CADE2 computer.

All of these wage garnishment levies are sent out systemically by the Internal Revenue Service in their untouched by human hands.

How long is the wage garnishment levy in effect

The IRS wage garnishment is a continual levy and does not stop until he employer receives an actual release of the federal tax wage garnishment.

The form the IRS sends to garnish a person’s wages is a form 668-W. A taxpayer should immediately contact a tax professional or the Internal Revenue Service to start the process to get the IRS wage garnishment removed and the case settled.

What is needed to get the wage garnishment released

To get the wage garnishment released from the Internal Revenue Service a taxpayer will have to provide a current financial statement to the Internal Revenue Service.

That form is the 433-F and you can find that financial statement on our website.

That form will need to be sent or faxed to the Internal Revenue Service along with the last pay stubs, the last 3 to 6 months bank statements, and a copy of all income and expenses for the last three months.

IRS will use the national and regional standards to assess your financial statement before they make a determination on your case.

IRS may also request that all federal income tax returns be filed and brought up to date and evidence or proof that you are making current tax deposits or have enough withholding being taken now your check at the situation will not occur again.

How soon can you get the IRS wage garnishment removed

As soon as IRS gets a fully completed 433F with all the associated documentation the IRS will begin the process of closing your case off the IRS enforcement computer and releasing your Wage Garnishment .

To do that IRS will need a closing method in which to close the case.

As a general rule the IRS closes case is one of three ways.

After the Internal Revenue Service analyzes your case they will determine that you are either a financial hardship candidate, you are suitable for installment agreement, or you are a tax settlement candidate and will let you know that you should file an offer in compromise.

Offers in compromise or IRS tax debt settlement should not be done without professional tax help. As a former IRS agent and teaching instructor of the offer in compromise I can tell you first hand the OIC is much more complicated than people ever think.

IRS accepts about 29% of all the offers in compromise filed and my hunch is that a 90% of those that are accepted are filed by professional tax companies.

The Internal Revenue Service can do more than just send a wage garnishment out

Keep in mind the Internal Revenue Service to not have to stop with just the wage garnishment. IRS has the option of issuing a bank levy to your financial institutions and also has the ability of file a federal tax lien. It is extremely important to contact the IRS and resolve this problem as soon as possible.

Contact us today. We are comprised of IRS tax attorneys, certified public accountants, and former IRS agents managers instructors.

We are A+ rated by the Better Business Bureau have been in private practice since 1982.

Wage Garnishment – IRS Tax Attorneys, Lawyers – Experts in Wage Garnishments Removal, Settlements

by Fresh Start Tax | Mar 19, 2013 | Tax Help

Trucker Drivers – Tax Preparation, Back Tax Returns – Tax Settlements 1-866-700-1040

We are former IRS agents, managers, and instructors who are experts in the trucking industry.

We have prepared hundreds of returns for both truck drivers and those in the industry and can assure and guarantee to you that you will pay the lowest amount allowed by law.

Being former IRS agents and managers we know all available tax deductions and loopholes to make sure you’re paying only your fair share.

Back or Unfiled Tax Returns

If you have not filed your back tax returns we can file all back years whether you have records or have lost your records. We are experts in IRS tax reconstruction. We can easily get you back into the IRS system to not be worried if you have multiple back years of tax returns you have the file.

Because we have prepared so many tax returns for truck drivers and those in the industries we have good idea of what the percentages and standards are for everyone in this field.

Business Travel Expenses

Travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job.

Generally, employees deduct these expenses using Form 2106 (PDF) or Form 2106-EZ (PDF) and on Form 1040, Schedule A (PDF).

You cannot deduct expenses that are lavish or extravagant or that are for personal purposes.

You are traveling away from home if your duties require you to be away from the general area of your tax home for a period substantially longer than an ordinary day’s work, and you need to get sleep or rest to meet the demands of your work while away.

Generally, your tax home is the entire city or general area where your main place of business or work is located, regardless of where you maintain your family home.

An example

For example, you live with your family in Chicago but work in Milwaukee where you stay in a hotel and eat in restaurants. You return to Chicago every weekend. You may not deduct any of your travel, meals, or lodging in Milwaukee because that is your tax home. Your travel on weekends to your family home in Chicago is not for your work, so these expenses are also not deductible.

If you regularly work in more than one place, your tax home is the general area where your main place of business or work is located.

In determining your main place of business, take into account the length of time you are normally required to spend at each location for business purposes, the degree of business activity in each area, and the relative significance of the financial return from each area. However, the most important consideration is the length of time spent at each location.

Travel expenses paid or incurred in connection with a temporary work assignment away from home are deductible. However, travel expenses paid in connection with an indefinite work assignment are not deductible.

Any work assignment in excess of one year is considered indefinite.

Also, you may not deduct travel expenses at a work location if it is realistically expected that you will work there for more than one year, whether or not you actually work there that long.

If you realistically expect to work at a temporary location for one year or less, and the expectation changes so that at some point you realistically expect to work there for more than one year, travel expenses become nondeductible when your expectation changes.

You may deduct travel expenses, including meals and lodging, you had in looking for a new job in your present trade or business. You may not deduct these expenses if you had them while looking for work in a new trade or business or while looking for work for the first time.

If you are unemployed and there is a substantial break between the time of your past work and your looking for new work, you may not deduct these expenses, even if the new work is in the same trade or business as your previous work.

Travel expenses for conventions are deductible if you can show that your attendance benefits your trade or business.

Special rules apply to conventions held outside the North American area.

Deductible travel expenses while away from home include, but are not limited to, the costs of:

a. Travel by airplane, train, bus, or car between your home and your business destination. (If you are provided with a ticket or you are riding free as a result of a frequent traveler or similar program, your cost is zero.)

b. Using your car while at your business destination. You can deduct actual expenses or the standard mileage rate, as well as business-related tolls and parking fees. If you rent a car, you can deduct only the business-use portion for the expenses.

c. Fares for taxis or other types of transportation between the airport or train station and your hotel, the hotel and the work location, and from one customer to another, or from one place of business to another.

d. Meals and lodging.

e. Tips you pay for services related to any of these expenses.

f. Dry cleaning and laundry.

g. Business calls while on your business trip (This includes business communications by fax machine or other communication devices).

h. Other similar ordinary and necessary expenses related to your business travel (These expenses might include transportation to and from a business meal, public stenographer’s fees, computer rental fees, and operating and maintaining a house trailer).

i. Shipping of baggage, and sample or display material between your regular and temporary work locations.

Instead of keeping records of your meal expenses and deducting the actual cost, you can generally use a standard meal allowance, which varies depending on where you travel.

The Trucker Drivers – Tax Preparation, Back Tax Returns – Tax Settlements

by Fresh Start Tax | Mar 19, 2013 | Tax Help

Trucker Drivers, IRS Tax Problem Help – File, Settlements, Tax Levy Relief 1-866-700-1040

Use Former IRS agents to resolve your tax problems. Fast and Affordable

We are IRS Tax Experts who specialize in Tax Relief for all those in the trucking industry. We have represented thousands of clients throughout the years and can help you through any IRS tax problem that you may have.

We are comprised of tax attorneys, CPAs, and former IRS agents with over 206 years of professional tax experience.

We are very affordable and assessable.

We have over 60 years of working directly for the Internal Revenue Service in the local, district, and regional offices of the Internal Revenue Service.

We can resolve any IRS problem you may have.

We know all there is to know about the problems and situations that truck drivers face every day.

We audited their tax returns as former IRS agents so it only makes sense that we know the exact protocol could become their best advocate for any IRS problem they may have.

As former IRS agents we sent out many tax liens and tax levies on truck drivers who failed to pay their back taxes. As a result of our best years of experience we can help work out tax settlements and relieve you of the IRS pressures you may have.

Due to the demands of being on the road all the time many times it is impossible for truck drivers and those in the industry to find time to file their tax returns.

Also due to the demand of high fuel costs and other related truck expenses the monies truckers receive are being eaten alive just trying to keep their trucks on the road.

Call us today and let us be your tax representative for any issues that you may have. We can file any back tax returns or file a current tax return you have and make sure that you pay the lowest amount allowed by law.

Call us today for free initial tax consultation.

Our Company Resume: ( Since 1982 )

-

Our staff has collectively over 205 years of Professional IRS Tax Representation Experience

-

On staff, Board Certified Tax Attorney’s, IRS Tax Lawyers, Certified Public Accountants, Enrolled Agents,

-

We taught Tax Law in the IRS Regional Training Center

-

Former IRS Agents, Managers and Instructors with over 60 years experience in the local, district and regional IRS offices.

-

Highest Rating by the Better Business Bureau “A” Plus

-

Fast, affordable, and economical

-

Licensed and certified to practice in all 50 States

-

Nationally Recognized Veteran /Published Former IRS Agent

-

Nationally Recognized Published EZINE Tax Expert

-

As heard on GRACE Net Radio.com – Monthly Radio Show-Business Weekly

Areas of Professional Tax Practice:

-

Same Day IRS Tax Representation

-

Offers in Compromise or IRS Tax Debt Settlements

-

Immediate Release of IRS Bank Levies or IRS Wage Garnishments

-

Tax Relief from a IRS Bill, Letter or Notice of “Intent to Levy”

-

IRS Tax Audits

-

IRS Hardships Cases or Unable to Pay

-

Payment Plans, Installment Agreements, Structured agreements

-

Abatement of Penalties and Interest

-

State Sales Tax Cases

-

Payroll / Trust Fund Penalty Cases / 6672

-

Filing Late, Back, Unfiled Tax Returns

-

Tax Return Reconstruction if Tax Records are lost or destroyed

- Trucker Driver Experts

Trucker Drivers, IRS Tax Help – File, Settlements, Tax Levy Relief

by Fresh Start Tax | Dec 1, 2012 | IRS Notice or Letter, Tax Help, Uncategorized

IRS Notice, Letter CP 503 – Affordable, Former IRS, Tax Solutions, Settlements, Hardships – Fresh Start Tax LLC

Fresh Start Tax LLC is a IRS tax specialty firm. Since 1982, the principles of Fresh Start Tax LLC have been successfully resolving IRS tax issues and problems. We are the Affordable Firm.

You have options so do not panic.

All tax consultations are free. You will speak directly to a true tax professional.

We have over 60 years of direct IRS work experience and over 205 years of total tax experience.

We taught Tax Law at the IRS.

The IRS Notice and Letter CP- 503

The IRS Notice or Letter is the third letter or notice that the IRS CADE 2 computer system generates to a taxpayer. all letters and notices are sent out on a 5 week billing cycles.

It is the last friendly notice that the IRS sends to taxpayers, after this it gets nasty, real nasty.

You can stop the IRS with one call.

The very next Notice or Letter after the CP 503 sent out 5 weeks later is an Intent to Seize. That seizure is in the form of a IRS Bank Levy or a IRS Wage Garnishment.

At this point you have different settlement options.

You can have Fresh Start Tax LLC contact the IRS and get your case closed in one of the following ways:

1. A Hardship, unable to pay the tax at this time because of financial conditions in your life,

2. The filing of a settlement agreement called the offer in compromise.

3. A payment plan or payment agreement,

IRS will require a IRS financial statement that you can find on our website. The IRS will review the financial statement and the documentation to verify the statement and will negotiate with us a means of settlement.

We can get you results you are looking for. Call us today and stop the worry.

Our 205 years of experience can get you results. 1-866-700-1040.

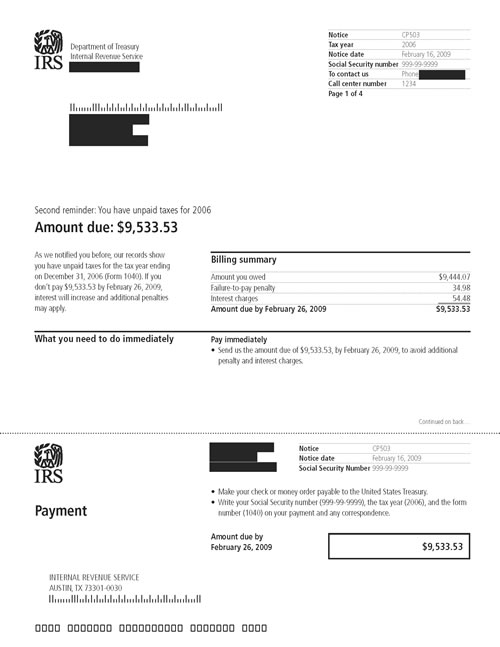

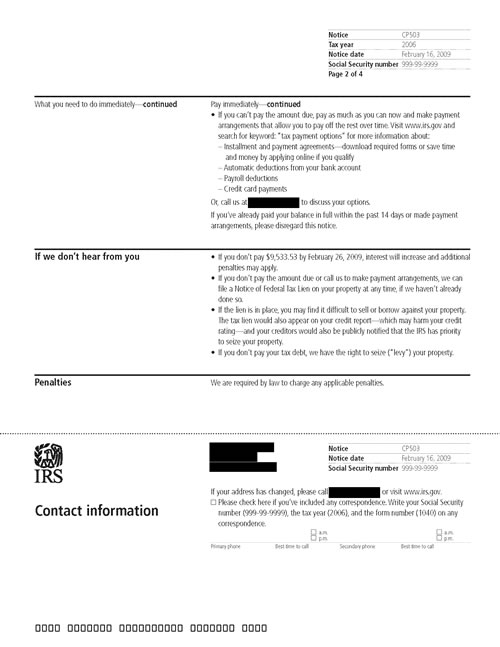

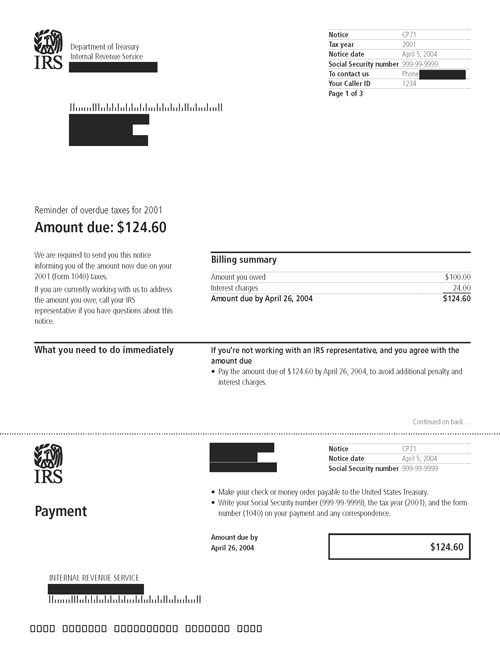

What the CP 503 will look like.

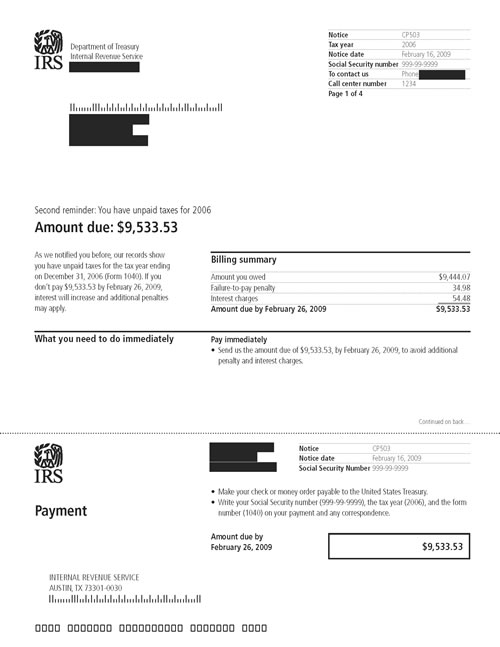

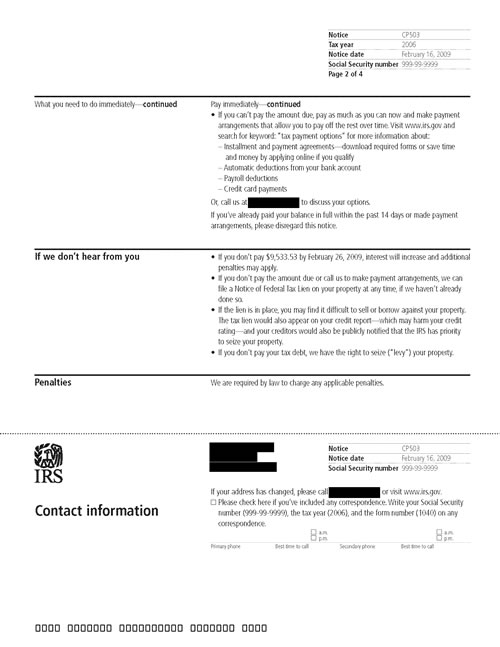

Notice CP503, Page 1

Notice CP503, Page 2

IRS Notice, Letter CP 503 – Affordable, Former IRS, Tax Solutions, Settlements, Hardships – Fresh Start Tax LLC

by Fresh Start Tax | Nov 26, 2012 | IRS Notice or Letter, Tax Help

IRS Notice CP 71, 71A, – IRS Tax Help & Representation, Former IRS – Affordable – Fresh Start Tax LLC 1-866-700-1040 Free Consult.

You can stop the worry right now! This may be the time to settle.

The CP -71 and the whole series of CP- 71’s is a kindly reminder from the IRS that you owe money to them.

The good news is that your case is not in the active CADE 2 computer system of the IRS. For some reason your case is in the inactive file.

Being a Former IRS agent, this holding process fools may taxpayers thinking that the IRS will forget about them and taxpayers bury their heads in the sand. The smart ones will figure a strategy to end there problem for good and this is the very best time to do so.

Why?

Because the IRS feels at this time you cannot pay and will probably accept a settlement proposal. IRS now accepts about one third of all offers.

Do not be lulled into a false reality. Your case will be coming back into the field for active enforcement in the upcoming future.

Call us today for more details. 1-866-700-1040

It is wise to figure out an exists strategy.

The Offer in Compromise can settle your case for pennies on a dollar.

An offer in compromise allows you to settle your tax debt for less than the full amount you owe.

It very well may be a legitimate option if you cannot pay your full tax liability and or doing so creates a financial hardship. IRS considers your unique set of facts and circumstances:

- Ability to pay;

- Income;

- Expenses; and

- Asset equity.

IRS will generally approve an offer in compromise when the amount offered represents the most we can expect to collect within a reasonable period of time.

Select a payment option to the IRS for Settlement

Your initial payment will vary based on your offer and the payment option you choose:

a. Lump Sum Cash:

Submit an initial payment of 20 percent of the total offer amount with your application. Wait for written acceptance, then pay the remaining balance of the offer in five or fewer payments.

b.Periodic Payment:

Submit your initial payment with your application. Continue to pay the remaining balance in monthly installments while the IRS considers your offer. If accepted, continue to pay monthly until it is paid in full.

If you meet the Low Income Certification guidelines.

You do not have to send the application fee or the initial payment and you will not need to make monthly installments during the evaluation of your offer. See your application package for details.

Understand the Offer in Compromise or Debt Settlement process

While your IRS offer is being evaluated:

1. Your non-refundable payments and fees will be applied to the tax liability,

2. A Notice of Federal Tax Lien may be filed,

3. Other collection activities are suspended,

4. The legal assessment and collection period is extended,

5. Make all required payments associated with your offer,

6. You are not required to make payments on an existing installment agreement.

Call us today for more details and end your problem once and for all.

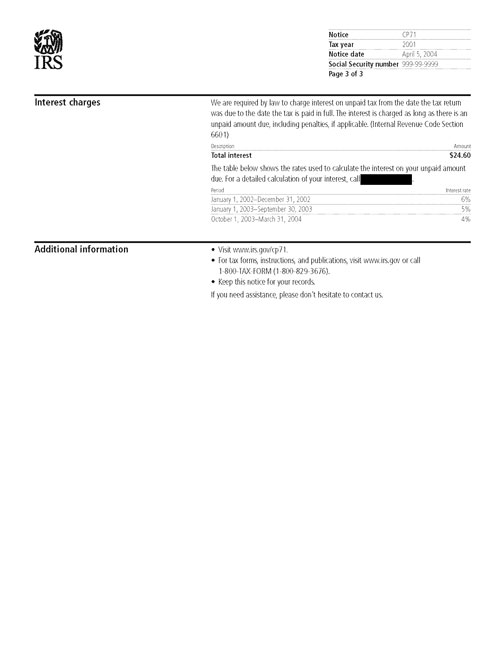

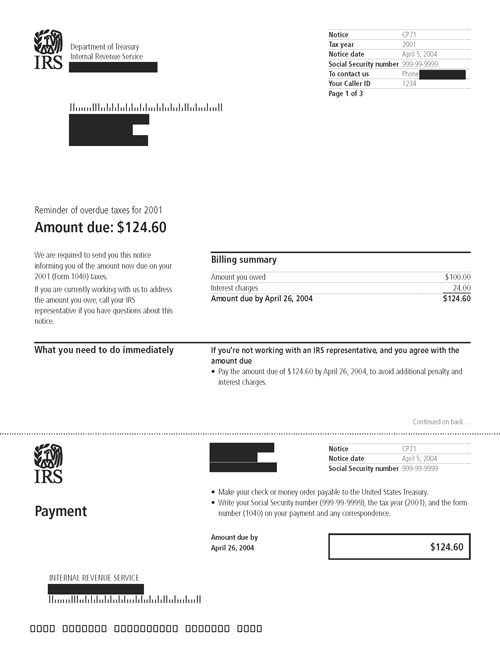

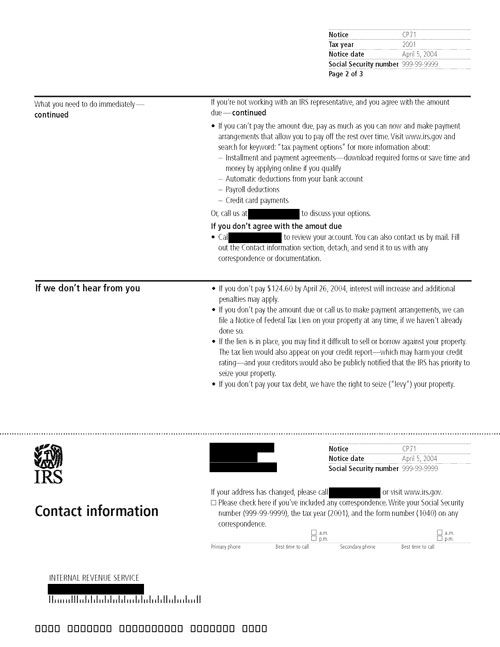

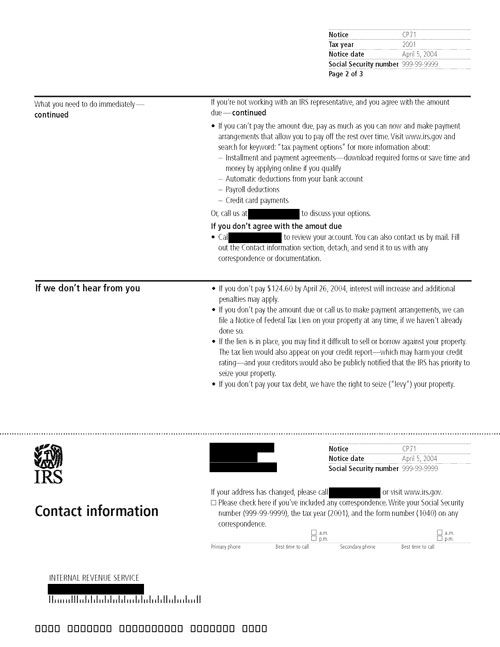

Notice CP71,

Notice CP71, Page 2

Notice CP71, Page 3