IRS Notice CP 71, 71A, – IRS Tax Help & Representation, Former IRS – Affordable – Fresh Start Tax LLC 1-866-700-1040 Free Consult.

You can stop the worry right now! This may be the time to settle.

The CP -71 and the whole series of CP- 71’s is a kindly reminder from the IRS that you owe money to them.

The good news is that your case is not in the active CADE 2 computer system of the IRS. For some reason your case is in the inactive file.

Being a Former IRS agent, this holding process fools may taxpayers thinking that the IRS will forget about them and taxpayers bury their heads in the sand. The smart ones will figure a strategy to end there problem for good and this is the very best time to do so.

Why?

Because the IRS feels at this time you cannot pay and will probably accept a settlement proposal. IRS now accepts about one third of all offers.

Do not be lulled into a false reality. Your case will be coming back into the field for active enforcement in the upcoming future.

Call us today for more details. 1-866-700-1040

It is wise to figure out an exists strategy.

The Offer in Compromise can settle your case for pennies on a dollar.

An offer in compromise allows you to settle your tax debt for less than the full amount you owe.

It very well may be a legitimate option if you cannot pay your full tax liability and or doing so creates a financial hardship. IRS considers your unique set of facts and circumstances:

- Ability to pay;

- Income;

- Expenses; and

- Asset equity.

IRS will generally approve an offer in compromise when the amount offered represents the most we can expect to collect within a reasonable period of time.

Select a payment option to the IRS for Settlement

Your initial payment will vary based on your offer and the payment option you choose:

a. Lump Sum Cash:

Submit an initial payment of 20 percent of the total offer amount with your application. Wait for written acceptance, then pay the remaining balance of the offer in five or fewer payments.

b.Periodic Payment:

Submit your initial payment with your application. Continue to pay the remaining balance in monthly installments while the IRS considers your offer. If accepted, continue to pay monthly until it is paid in full.

If you meet the Low Income Certification guidelines.

You do not have to send the application fee or the initial payment and you will not need to make monthly installments during the evaluation of your offer. See your application package for details.

Understand the Offer in Compromise or Debt Settlement process

While your IRS offer is being evaluated:

1. Your non-refundable payments and fees will be applied to the tax liability,

2. A Notice of Federal Tax Lien may be filed,

3. Other collection activities are suspended,

4. The legal assessment and collection period is extended,

5. Make all required payments associated with your offer,

6. You are not required to make payments on an existing installment agreement.

Call us today for more details and end your problem once and for all.

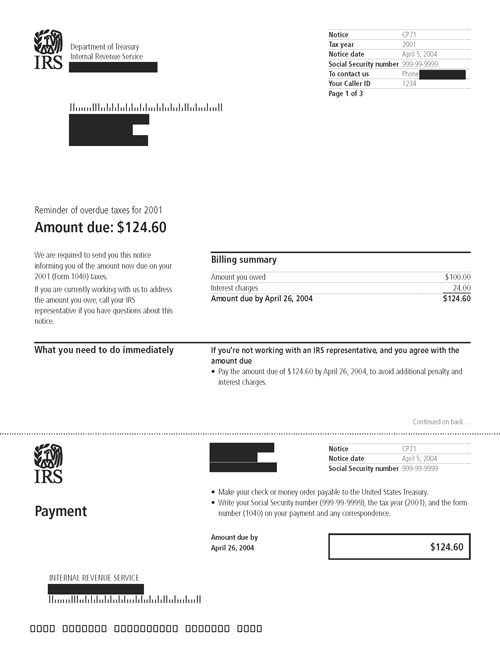

Notice CP71,

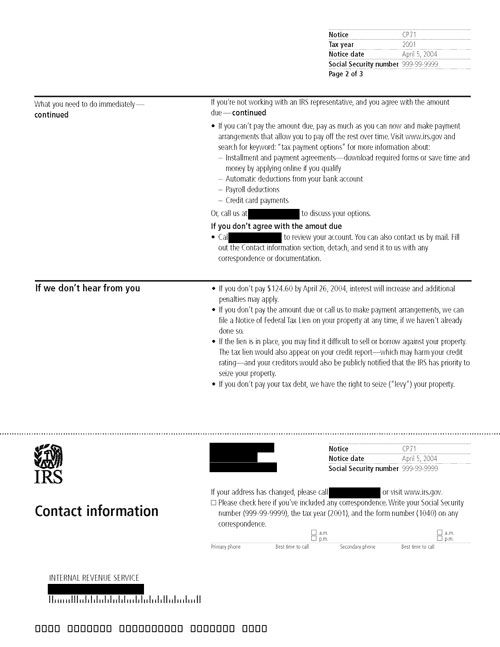

Notice CP71, Page 2

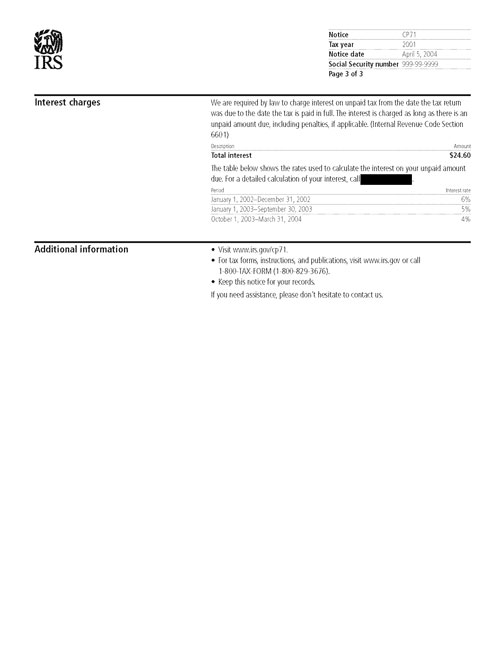

Notice CP71, Page 3