by Fresh Start Tax | Jan 3, 2019 | Tax Help

Receiving an IRS notice letter or tax bill can be a very frightening experience.

Most taxpayers hate to open IRS mail and usually when they receive this in the mail there is a sick feeling in the pit of their stomach.

There is no need to worry, have anxiety or start being stressed about the matter there is always a resolution to the issue and many times IRS is wrong.

Your tax case is in the system somewhere and the letter or notice helps you identify what is going on and what must be fixed whether it is a bill, notification or even an IRS audit notice. If it is a simple matter you can handle it yourself if not you should call a tax professional that has loads of experience to deal with the IRS notice, IRS letter, Iris tax bill.

We are a team of Former IRS agents and managers that can end your problem now.

Since 1982, A plus Rated. STOP IRS NOW! AFFORDABLE

We have over 65 years of working directly for the Internal Revenue Service and the local, district, and regional tax offices of the IRS. We know the system inside and out.

If you received a letter, notice or tax bill from the IRS we can help. Stop the stress and resolve your IRS problem.

You will never have to speak to the IRS! 1-866-700-1040

YOU MUST ACT ON A CERTIFIED LETTER OR NOTICE.

IRS Contacts Taxpayers by Letter or Notification 4 Different Ways:

1. By certified mail

2. By notice of federal tax levy or be filing of federal tax lien

3. By regular mail

4. By telephone

So What Is Your Next Step?

First of all, do not panic.

The IRS is just trying to resolve an open issue.

Most IRS letters, notices or bills come with a time frame of ten to thirty days to respond to the notification.

You should respond within the time period specified or the IRS will follow-up and eventually use enforcement action. If you do not respond to the IRS’s attempts to reach you they will hit you with a Federal Tax Lien, a Wage Levy on your paycheck or a Tax Lien on your bank account.

IRS only sends out tax levies after a series of 5 letters are sent to the taxpayer. These are sent about 5 weeks apart.

1. CP 14 – This is the notice of balance due,

2.CP 501 – This is a Bill that you still owe tax,

3. CP503 – Important, Immediate Action Required

4. CP 504 Urgent Notice – We Intend to Levy on Certain Assets, Please Respond Now

5. CP90/CP297/ IRS Letter 1058 – Final Notice of Intent to Levy of Your Right to a Hearing

6.CP 91 CP298 -Final Notice Before Levy on your Social Security Benefits

Contact By Certified Mail

When IRS contacts you by certified mail it is time to be serious about the next step. The IRS has tried to contact you before to resolve the issue and has been unsuccessful.

Certified letters from the IRS usually means they are ready to take enforcement action. Unless you reach them within the prescribed period of time the IRS will probably levy your wages or bank account and file a Federal Tax Lien.

It is time to call your Fresh Start Tax Professional. In most cases, within a thirty-day period of time, the IRS will send a wage levy to your employer, and or a bank levy to your bank accounts.

Whether you sign for the IRS certified mail or not, the 30 day period starts on the date of the IRS letter.

Before you make any contact with the IRS you want to know your rights so you don’t make the situation worse than it already is. This requires a plan of action. Contact Fresh Start Tax as soon as possible and we will contact the IRS immediately to stop any collection activity.

The CADE2 computer is the issuer of IRS Letters and Notices

The Internal Revenue Service is spending millions and millions of dollars on their CADE2 computer. This is the computer giant that belongs to Internal Revenue Service and all its systems are held within this massive computer.

All IRS notices, letters and bills that go to taxpayers are generated from the system.

All the information that this computer generates is handled systemically and not a human hand will ever touch a piece of paper you receive.

To stop the issuance’s of IRS notices and IRS letters you must contact an Internal Revenue Agent who can directly make changes to the CADE2 computer.

Usually you will find this on a 1-800 number on your letter, notice or bill.

If you do not contact the Internal Revenue Service at some point in time enforcement action will begin.

It is critical you contact the Internal Revenue Service at the number shown on Letter or Notice to stop or correct the problem or situation.

The worst thing you can do is not respond to the IRS notice her letter because I can assure you you will not be happy with the consequences.

I can tell you as a former IRS agent these letters are notices will not go away.

Should you need a free tax consultation speak to a true IRS expert regarding an IRS notice, an IRS tax bill, or IRS letter contact us today for a free initial tax consultation.

by Fresh Start Tax | Sep 27, 2018 | Tax Help

Have you received an IRS notice or letter, CP 515. Get former IRS agents and managers to help stop IRS.

If you have back tax returns to file we can file those tax returns with or without records and settle with the Internal Revenue Service all at the same time.

Since 1982 we have been resolving individual tax problems.

CP515 Individuals Notice

The CP 515 letter is a notice sent out by the Internal Revenue Service asking to file a back tax return. is in the taxpayer’s best interest to contact Internal Revenue Service and make sure all their tax returns are filed.

If you have file tax returns you should contact IRS and let them know and send copies and if you haven’t you need to have a representative call IRS and straighten the problem out.

If you don’t under 6020 B of the Internal Revenue Code IRS can prepare your tax returns for you and you will pay the highest amount allowed by law.

Feel free to call us today and we will answer any questions you have or we can help resolve your problem and you will never have to speak to the Internal Revenue Service.Hear the truth by true IRS tax experts.

Answers to common questions

What should I do if I disagree with the notice?

Call us at the toll-free number on the top right corner of your notice. Please have your paperwork ready when you call. If you prefer, you can write to us using the notice’s response form. Enclose it in the envelope we’ve provided.

What should I do if I’ve just filed my tax return?

You don’t have to do anything if you filed your tax return within the last 8 weeks.

What should I do if I didn’t file my tax return or it’s been more than 8 weeks since I filed it?

Complete the response form from your notice. Check the name, Social Security number (SSN), and tax year on your notice. Make sure they match the name, SSN, and year on the return. Mail us a signed, dated copy of the tax return with the response form.

What happens if I cannot pay the full amount I owe when I file my return?

You can request a payment plan with us when you cannot pay the full amount you owe.

What if I need copies of my income information received by the IRS?

You can get copies by using the Get Transcript option available online.

IRS Notice Letter CP515 + Get Former IRS Agent Help and Stop IRS + File Back Tax Returns

by Fresh Start Tax | Dec 1, 2012 | IRS Notice or Letter, Tax Help, Uncategorized

IRS Notice, Letter CP 503 – Affordable, Former IRS, Tax Solutions, Settlements, Hardships – Fresh Start Tax LLC

Fresh Start Tax LLC is a IRS tax specialty firm. Since 1982, the principles of Fresh Start Tax LLC have been successfully resolving IRS tax issues and problems. We are the Affordable Firm.

You have options so do not panic.

All tax consultations are free. You will speak directly to a true tax professional.

We have over 60 years of direct IRS work experience and over 205 years of total tax experience.

We taught Tax Law at the IRS.

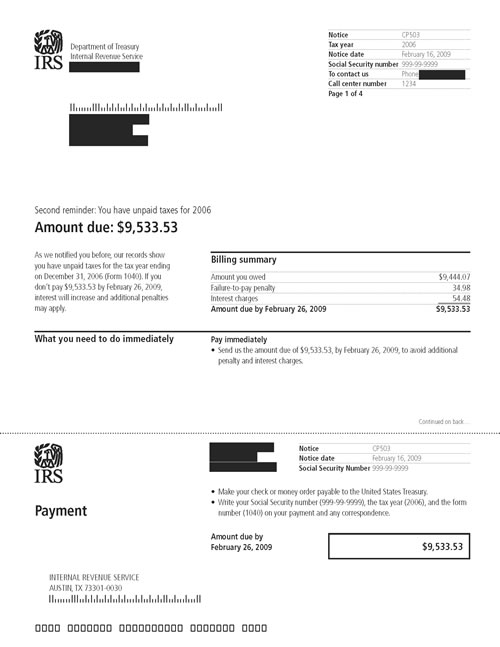

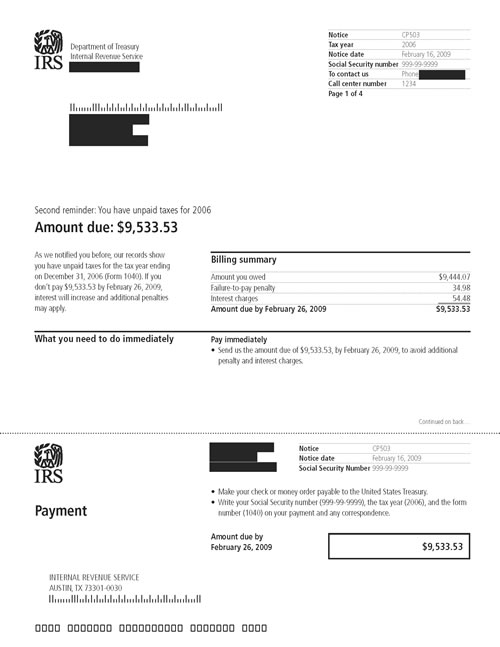

The IRS Notice and Letter CP- 503

The IRS Notice or Letter is the third letter or notice that the IRS CADE 2 computer system generates to a taxpayer. all letters and notices are sent out on a 5 week billing cycles.

It is the last friendly notice that the IRS sends to taxpayers, after this it gets nasty, real nasty.

You can stop the IRS with one call.

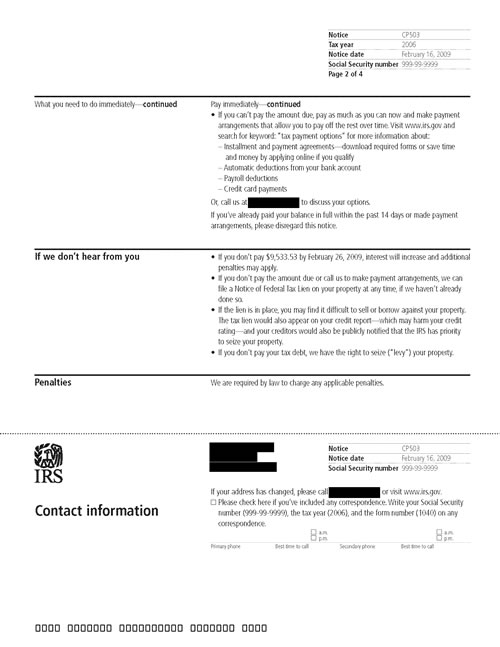

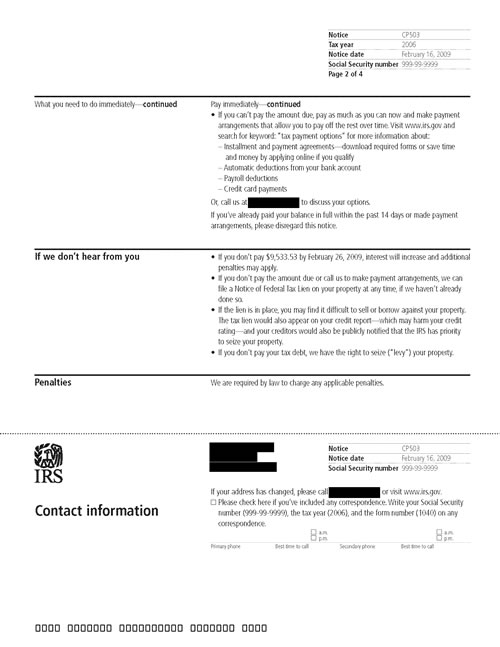

The very next Notice or Letter after the CP 503 sent out 5 weeks later is an Intent to Seize. That seizure is in the form of a IRS Bank Levy or a IRS Wage Garnishment.

At this point you have different settlement options.

You can have Fresh Start Tax LLC contact the IRS and get your case closed in one of the following ways:

1. A Hardship, unable to pay the tax at this time because of financial conditions in your life,

2. The filing of a settlement agreement called the offer in compromise.

3. A payment plan or payment agreement,

IRS will require a IRS financial statement that you can find on our website. The IRS will review the financial statement and the documentation to verify the statement and will negotiate with us a means of settlement.

We can get you results you are looking for. Call us today and stop the worry.

Our 205 years of experience can get you results. 1-866-700-1040.

What the CP 503 will look like.

Notice CP503, Page 1

Notice CP503, Page 2

IRS Notice, Letter CP 503 – Affordable, Former IRS, Tax Solutions, Settlements, Hardships – Fresh Start Tax LLC

by Fresh Start Tax | Nov 21, 2012 | IRS Notice or Letter

IRS Notice, Letter CP14 – IRS Settlement Tax Help – Former IRS Agents

If you are having a current IRS problem and need professional tax help from Former IRS Agents call us today. 1-866-700-1040.

Stop the worry today! We have over 60 years of direct IRS work experience. We are affordable.

If the IRS sent you a IRS Notice or Letter cp14 it is because there records and CADE2 computer show that you owe IRS a balance due on back taxes. If unresolved you can expected follow up action from the IRS.

If this is a simple problem to resolve, call IRS yourself.

Most CP 14 Notices or Letters are resolved by calling the IRS however you must have a settlement strategy in mind before calling the Internal Revenue Service.

Strategies include:

1. Offers in compromise,

2. Payment Agreements or,

3. Being placed in a IRS tax hardship for a period of time.

4. Contesting the liability.

It is important to act on this CP14 because the IRS will follow up by sending a series of more threatening notices or letters.

IRS sends there notices or letters out on a 5 week billing cycle. At some point in time you will receive a Final Notice intent to levy or seize. IRS will follow through with this threat and it is all done by computer. IRS will search levy sources they have in there files and send levies out to your employer or your bank. IRS may also file a Federal Tax Lien.

One simple call to IRS from Fresh Start Tax LLC will stop the IRS. After we will consult with out clients we will find out

1. if you actually owe the tax,

2. if the tax is not owed, correct the problem,

3. If you do owe the tax we will work out a tax settlement,

4. If abatement of penalties are in order we will do our best to remove or get rid of applicable penalties and interest.

Call us today and get immediate Tax Help for any IRS problem or situation 1-866-700-1040.

IRS Notice, Letter CP14 – IRS Settlement Tax Help – Former IRS Agents

by Fresh Start Tax | May 2, 2012 | IRS Notice or Letter, IRS Tax Problem, Tax Lawyer

If you have received a IRS Letter or Tax Notice here is what you need to know concerning the correspondence you have received from the Internal Revenue Service.

First of all never panic and if you need to speak to a former IRS Agents call Fresh Start Tax LLC 1-866-700-1040 and let true tax professionals help you through this situations.

Usually these problems are not as bad as you think.

The IRS sends millions and millions of letters and notices to taxpayers for a variety of reasons. Many of these letters and notices can be dealt with without having to call or visit an IRS office. Many times you can just send correspondence by mail back to the IRS to resolve the dispute.

What you need to know about IRS notices and letters:

1. There are a number of reasons why the IRS might send you a notices or letters. Tax Notices/Letters may request payment, notify you of account changes, or request additional information.

A notice always covers a very specific issue about your tax account or tax return. and always a specific tax year or tax period.

2. Each IRS letter or notice offers specific instructions on what action you need to take. Make sure you call back by the assigned follow up date on the letter.

3. If you receive a correction notice, you should review the correspondence and compare it with the information on your return. Make sure you have back up information to support your finding with the IRS.

4. If you agree with the correction to your account, then usually no reply is necessary unless a payment is due or the notice directs otherwise. Follow up and all correspondence and make sure the problem is fully resolved by the IRS.

5. If you do not agree with the correction the IRS made, it is important to respond as requested. You should send a written explanation of why you disagree and include any documents and information you want the IRS to consider along with the bottom tear-off portion of the notice.

You should mail the information to the IRS address shown in the upper left of the notice. Allow at least 30- 45 days for the IRS to response.

6. Most correspondence can be handled without calling or visiting an IRS office. However, if you have questions, call the telephone number in the upper right of the notice. Have a copy of your tax return and the correspondence available when you call to help the IRS respond to your inquiry.

7. It is important to keep copies of any correspondence with your records. You cannot email any information to the IRS.

One of the big mistake taxpayers tend to make is to assume the problem is fully resolved.

We at Fresh Start Tax LLC believe it is always best to call the IRS 60 days after you believe the situation should have been resolved and verify that with the IRS.

These matters will not go away until they are removed from the IRS CADE computer.

Remember, if you wind up owing the IRS money and the problem goes unresolved , the IRS will follow up with a Notice of Federal Tax Levy to banks and on wages.

IRS issues over 3.6 million bank levy ( levies ) and wage levy garnishments. The IRS also filed over 900,000 federal tax liens.

Should you need help call us now. On staff, Tax Attorneys and Former IRS Agents.